Participating teams move through a series of divergent and convergent phases to identify and select commercialization routes for given technologies or specific competencies.

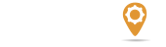

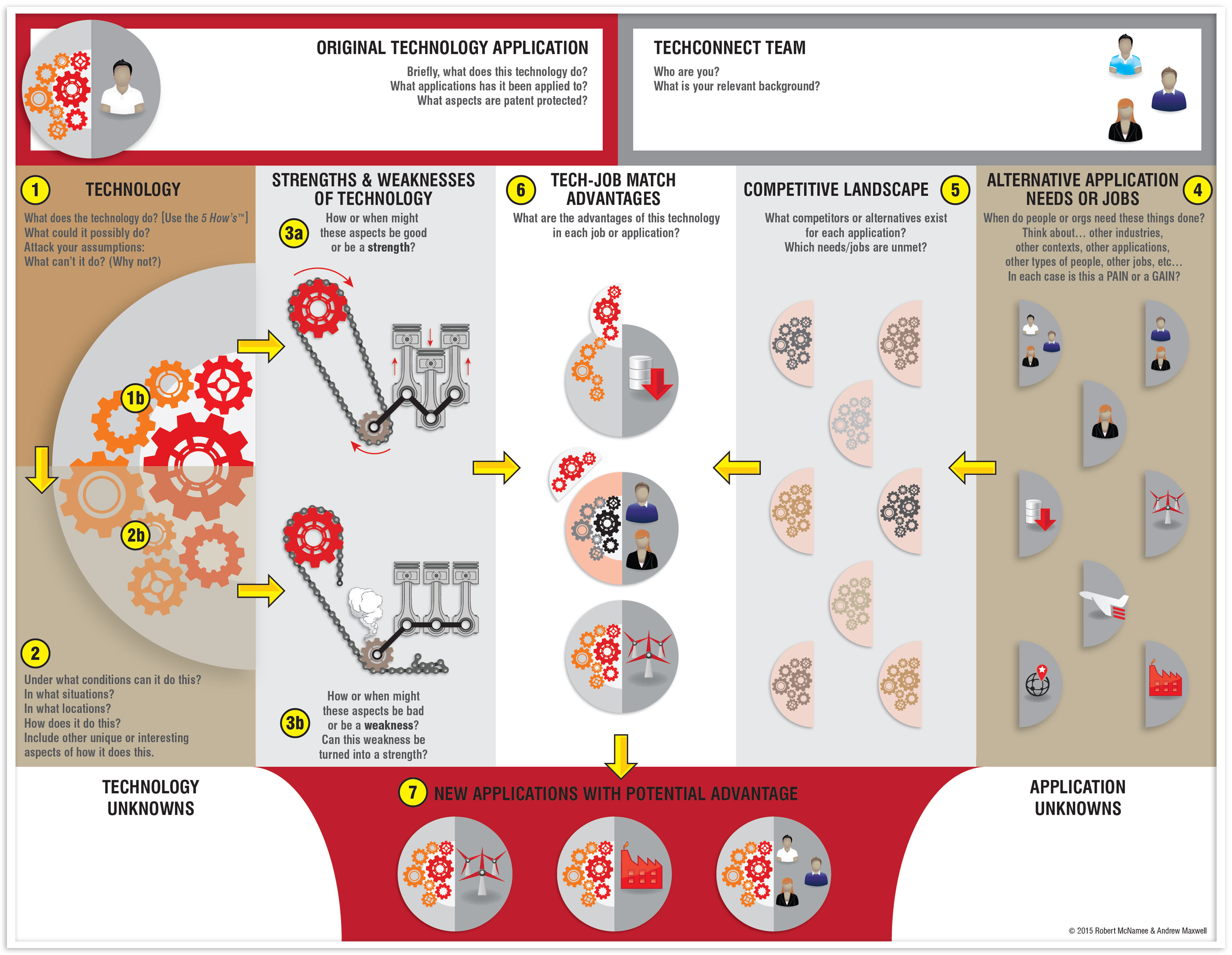

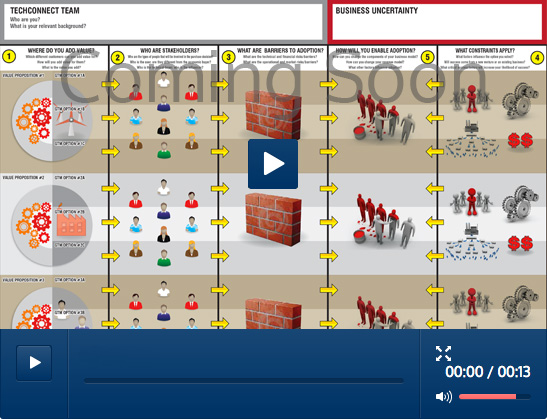

We have traditionally broken the Innovation Cartography roadmap into two large phases—1) exploring and prioritizing applications or customer jobs and 2) exploring and selecting business models and go-to-market strategies. These two phases are displayed in the Innovation Cartography Canvases below:

Canvas 1

The roadmap starts by assembling multi-functional teams around specific technologies. In part 1 of the Innovation Cartography process teams creatively explore the jobs that can be competitively accomplished with a given early-stage technology. This is done by 1) decoupling the technology from its initial application, 2) exploring how the technology works and what it can do, and then 3) exploring relevant applications in which users need comparable things accomplished. This can uncover multiple divergent development paths for the technology or can recognize technologies that have little current chance for commercial success. Following this, teams 4) examine the value proposition in each application, 5) identify competitors and substitutes in each case, and, finally, 6) select the most promising options for continued exploration.

Canvas 2

In the second half of the roadmap, teams identify stakeholders in the relevant industry ecosystems so that they can explore alternative business models. Prioritization is placed on models with fewer go-to-market barriers / challenges (e.g., costs, regulation, time, etc…) as well as models that enable customer adoption and network diffusion. Throughout the workshop unknowns, hypotheses, and developmental milestones necessary for pursuing commercialization are identified. This process is designed as a complement to traditional Lean Startup approaches which can be used in follow-up to evaluate hypotheses and resolve unknowns identified.

Decouple

The first step of the process decouples the technology from its initial application. This is a necessary step that precedes exploring market adjacencies and commercialization routes and allows teams to reduce the amount of assumptions they make regarding paths to market.

Dissect the Technology

Exploring how the technology works and what it can do is critical to identifying alternative applications (i.e., market adjacencies). We utilize a number of techniques such as the “5 How’s” to dig deeper into the root capabilities that underlie a technology since these give groups multiple jumping-off-points to identify others things that can be accomplished with the technology or capability.

Map Technology to Jobs

Ultimately commercial success comes from understanding customer needs. Thus a critical part of the overall process is understanding relevant customer jobs and envisioning value creation for different types of users. This is also a critical aspect of the learning outcome since it helps participants understand the difference between a technology and a job.

Competitors & Advantages

Openly exploring customer needs can lead to undifferentiated solutions in which an organization or scientist has no competitive advantage. Our process looks closely at competitors and substitutes as well as the unique nature of how the technology can accomplish jobs in order to prioritize and select jobs where the technology or capability has an advantage.

Technology-Job Match

The end result of the first phase of the Innovation Cartography process is selecting two to three high-potential technology-job matches for moving forward into the business model and go-to-market exploration phase of the process.

Value Propositions

Matching a technology to a specific application is just the start. Each application has many potential go-to-market strategies including different customer segments with relevant customer jobs-to-be-done as well as corresponding rough concepts of product-service-systems that makes up the offering and value proposition in each case. Our process helps identify several possible GTMS so that those with less barriers on the way to market as well as the strongest value proposition can be uncovered.

Ecosystem & Stakeholders

Each market application has an ecosystem that includes a critical set of stakeholders that you will create value for or that will be involved in the purchase decision as well as potential partners that can enable your GTMS. Our process encourages an analysis of relevant ecosystems for various promising GTMS being considered. We explore the potential to create win-win opportunities or otherwise align your business model with the goals and objectives of each stakeholder or potential partners so that inventors can better assess the most addressable market.

Adoption Barriers & Constraints

Adoption is frequently one of the most difficult behaviors to drive in first users and customers. Our approach utilized a number of approaches like Customer Journey Maps, Four Forces of Progress, and Innovation Characteristics to analyze barriers and opportunities to adoption of end users, purchasers, and partners.

Business Models

Our iterative process continuously revisits potential business models to seek optimal models to overcome barriers on the way to market. We challenge assumptions about customer segments targeted, design of product-service-systems in the offering, revenue models, relationships, and channels to identify the best route to encourage adoption and reach the identified market.

Go-To-Market Strategy

The final step of our process considers other factors that should influence which GTMS should be prioritized. Are there any other issues that would prevent you from launching your product via the GTMS identified? Which GTMS are most aligned with your organization current and future strategy? with the rest of your product portfolio? with your existing partnerships? with relevant trends? with organizational learning goals? What other uncertainty or unknowns need to be considered?